If someone slipped you a $10,000 check and told you to invest it, what would you do with the money? With no strings attached, there is a wide variety of ways that you could deploy that cash. You could look at it as a one-time windfall that could shore up your personal balance sheet, or you could go at it much more aggressively. It’s money that you didn’t expect to receive, so why not throw it at high-risk, high-reward assets?

How to Invest $10k?

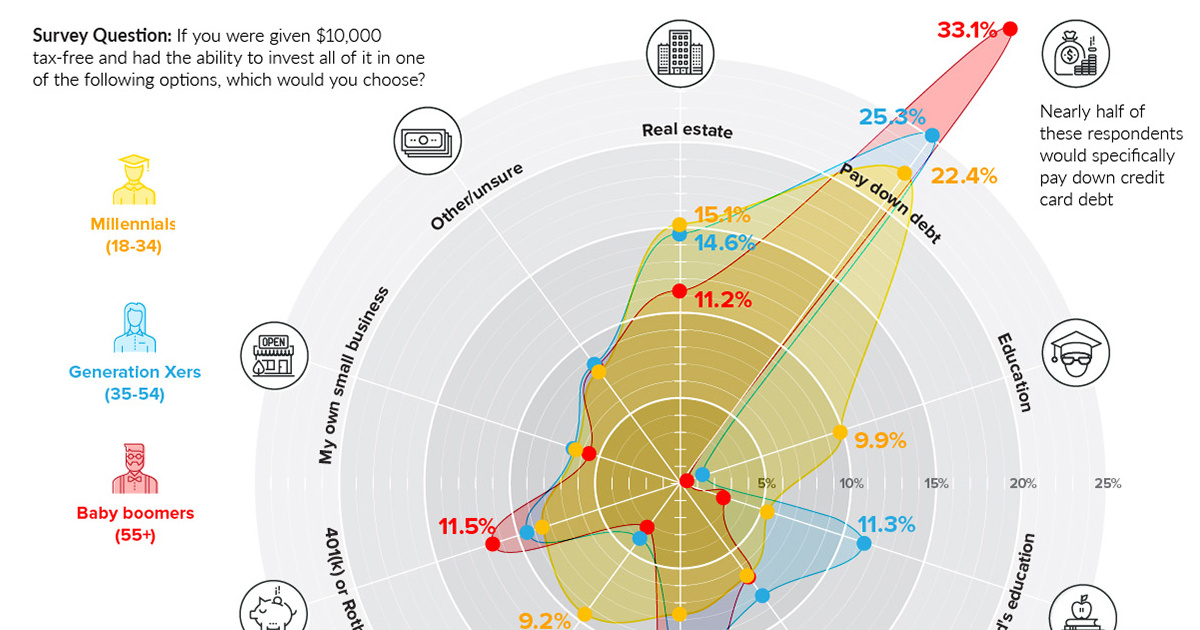

Today’s chart is based on a survey from LendEDU, which posed this exact question to 1,000 Americans in March 2018: Question: If you were given $10,000 tax-free and had the ability to invest all of it in one of the following options, which would you choose? Here are the results of the sample as a whole: Paying down debt (27.3%) was by far the most popular response. It’s also interesting to see that many people would opt to put the $10k towards their own small business, education, or even digital currencies like Bitcoin, Ethereum, or Litecoin. Now, here’s the same data grouped together by generations: Interestingly, certain answers had the same popularity across the board for all generations. All groups were equally interested in investing in their small businesses. The highest response here came from Gen X at 6.7%, but Millennials and Gen X weren’t far off at 6.3% and 5.6% respectively. In addition, investing in the stock market was pretty consistent as well, with Millennials at 6.6%, Generation X at 8.1%, and Boomers at 6.7%. All these groups were mostly interested in doing this through a human financial advisor, though Gen X gave robo-advisors a higher rate of consideration (20%) than other generations (11% Millennials, 4% Boomers)

Generational Differences

Some generational differences are as to be expected. For instance, barely any Baby Boomers (0.3%) wanted to put $10,000 towards their own education. This makes sense, since many are at or near retirement already. On the other hand, 9.9% of Millennials opted for an investment in education. But here’s a situation that might be a bit more peculiar. One would guess that with student debt being at $1.5 trillion in the United States, many Millennials would opt to pay down debt with their $10,000 check. Interestingly, fewer Millennials (22.4%) chose to pay down debt than either Gen X (25.3%) or Boomers (33.1%). On the same token, Millennials were more likely to choose either real estate (15.1%) or cryptocurrency (9.2%) as an investment. For contrast, look at Boomers, a group that had 11.2% choose real estate and only 3.1% choose crypto. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

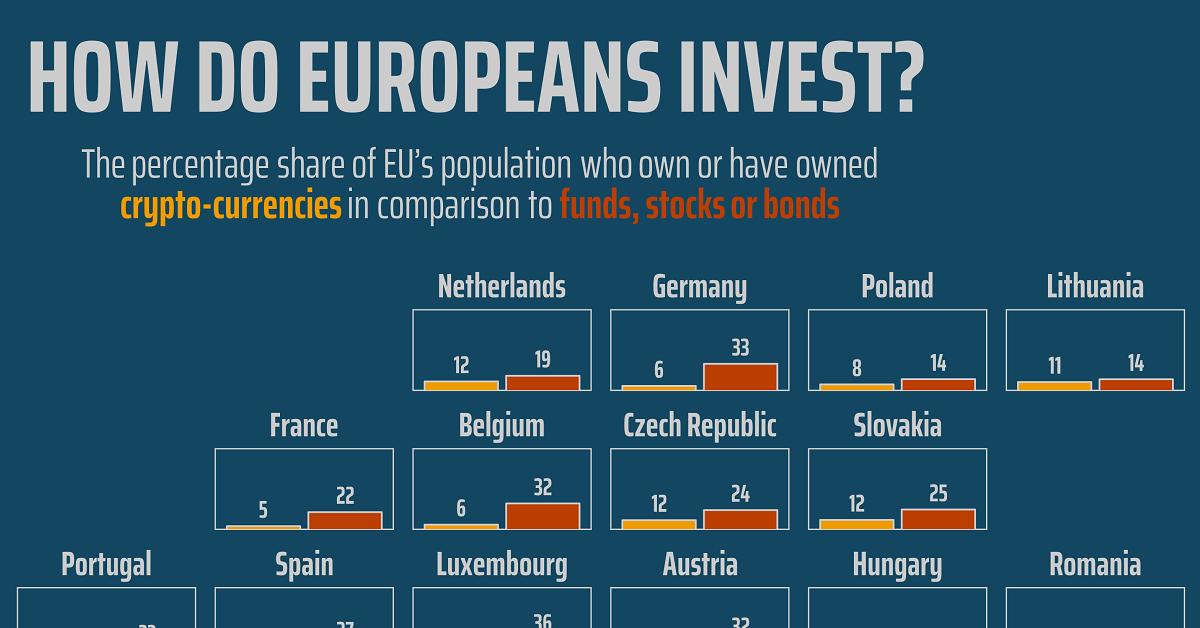

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.