As a foundational technology that things can be “built on top” of, the potential applications of the blockchain go way beyond just payments or cryptocurrencies. In fact, the blockchain could revolutionize how we interact with intellectual property, capital markets, insurance, healthcare, government, and many other sectors.

Introducing Smart Contracts

In particular, an exciting enabler of blockchain technology is the concept of self-executing “smart contracts”. Today’s infographic comes from Etherparty, a smart contract creation tool, and it helps provide a welcoming introduction to how smart contracts work on the blockchain. Smart contracts are going to change everything from the legal industry to the backbone of the stock market. Here’s how these self-executing contracts actually work.

The Anatomy of a Smart Contract

Smart contracts help you exchange money, property, shares, or anything of value in a transparent, conflict-free way while avoiding the services of a middleman. Built upon the blockchain, a smart contract is usually: Using the Ethereum platform, smart contracts can be programmed using basic logic. On the most basic level, they can:

Perform calculations (i.e. calculating interest) Store information (i.e. membership records) Send transactions to other accounts (i.e. payment for a good or service)

But most importantly, it is important to know that smart contracts are autonomous. They are not controlled by anyone – instead, they self-execute based on a set of instructions that two parties have agreed to (ie. the code).

Benefits of Smart Contracts

Smart contracts are appealing for a variety of reasons:

Autonomy: There is no need to rely on third parties, which could be biased or not have your interests at heart. Trust: Your documents are encrypted on a shared ledger, and all parties can have access to them. Redundancy: Documents are duplicated many times over on the blockchain, and can’t ever be “lost”. Safety: Documents are encrypted, making them near-impenetrable by hackers. Speed: These contracts automatically self-execute, saving you precious time. Savings: Smart contracts save you money by taking out the middleman. Precision: Smart contracts execute the exact code provided, ensuring zero errors. Transparency: For organizations like governments, they could add another level of transparency to dealings.

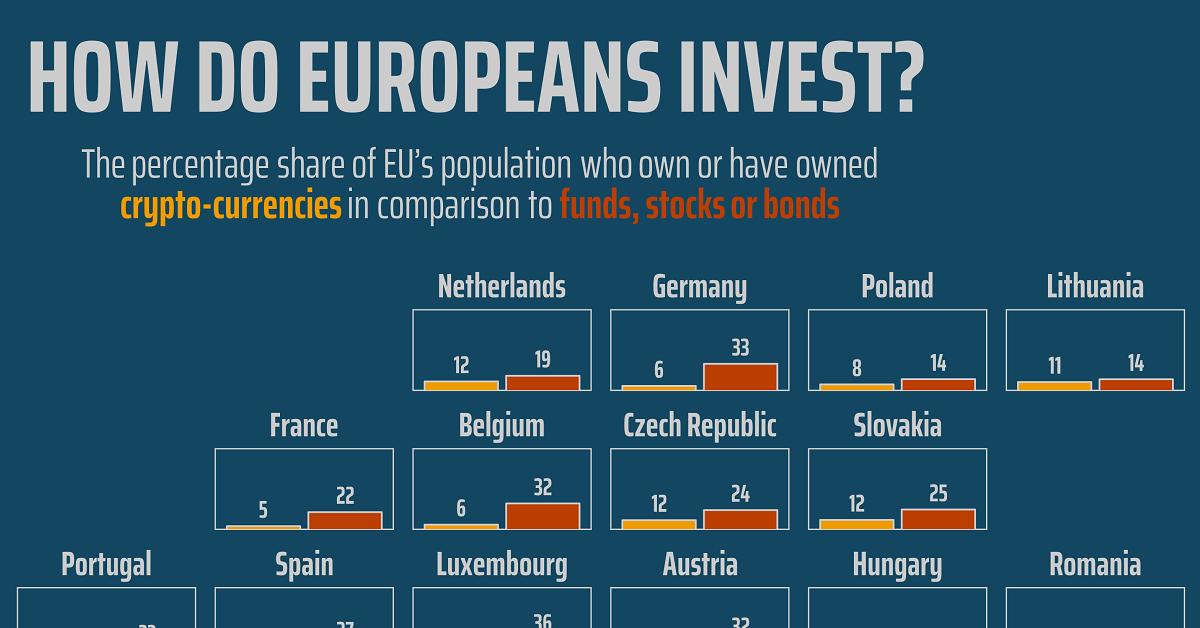

The blockchain is already a disruptive technology, and with these benefits – the potential behind smart contracts is another facet to be excited about. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.