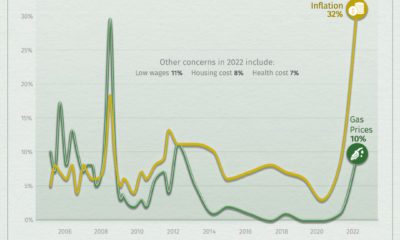

The report is also a useful tool to gauge the general mood in countries around the world—and when it comes to how people in developed economies feel about the near future, there’s a very clear answer: pessimistic. In fact, optimism about respondents’ economic prospects fell in the majority of countries surveyed. Here’s a full look how many respondents in 28 countries feel they and their families will be doing better over the next five years. Or, put more simply, what percentage of people are optimistic about their economic circumstances? Interestingly, nine countries (those with checkmarks above) are polling at all-time lows for economic optimism in survey history.

Whose Glass is Half Empty?

Japanese respondents were the most pessimistic, with only 15% seeing positive economic prospects in the near term. Only 18% of French respondents were economically optimistic. While most developed economies were slightly more optimistic than Japan and France, all are still well below the global average. As tensions between China and the U.S. continue to heat up in 2022, there is one thing that can unite citizens in the two countries—a general feeling that economic prospects are souring. As the U.S. heads into midterm elections and China’s 20th National Party Congress takes place, leaders in both countries will surely have the economy on their minds.

Whose Glass is Half Full?

Of course, the mood isn’t all doom and gloom everywhere. The United Arab Emirates saw a 6 percentage point (p.p.) jump in their population’s economic prospects. Indonesia saw an 11 p.p. increase, and in big developing economies like Brazil and India, the general level of optimism is still quite high. In some ways, it’s no surprise that people in developing economies are more optimistic about their economic prospects. Living standards are generally rising in many of these countries, and more opportunities open up as the economy grows. Even in the most pessimistic African country surveyed, South Africa, the majority of people still see improving circumstances in their near future. In Kenya and Nigeria, an overwhelming majority are optimistic.

Diverging Outcomes

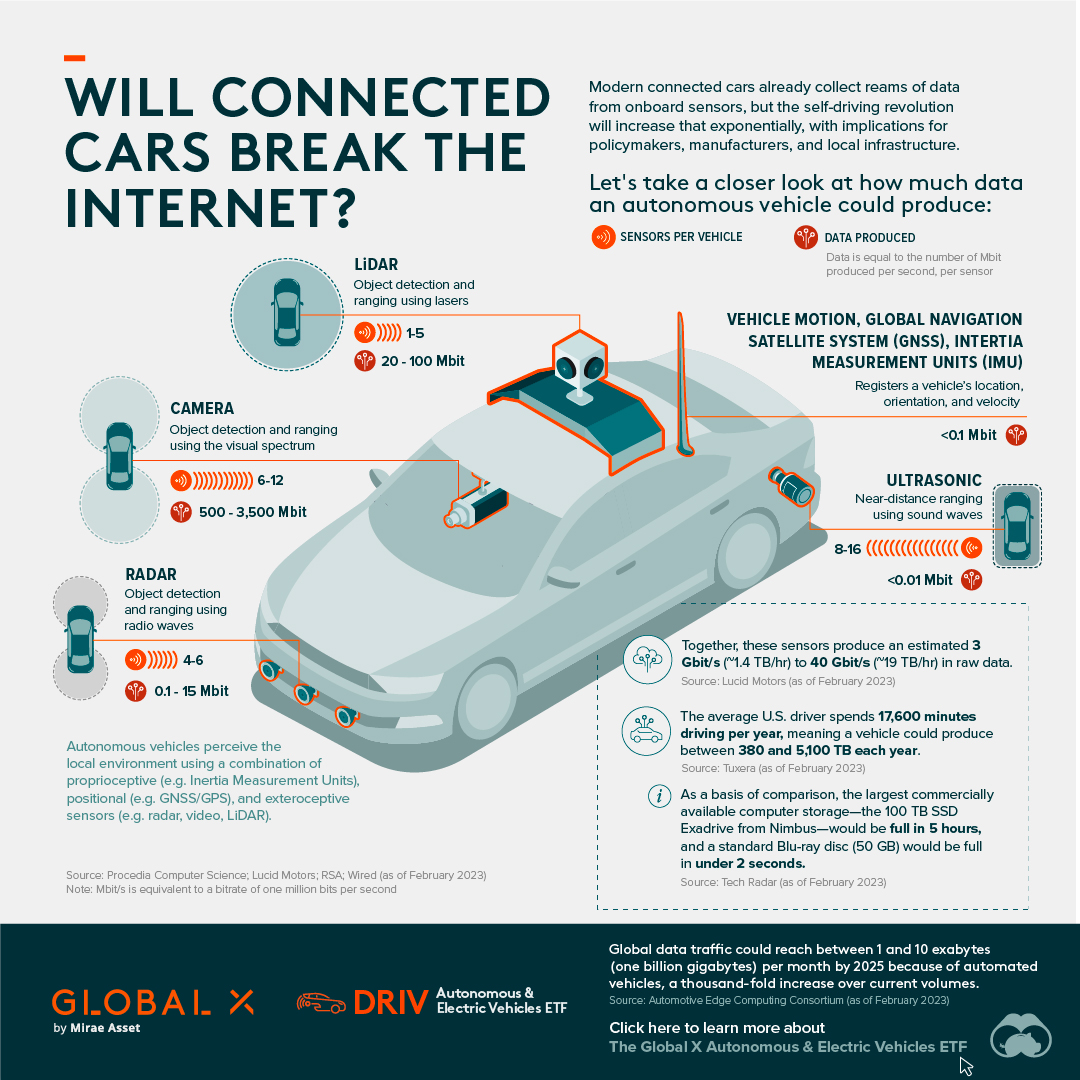

One major prediction that experts agreed on for the year ahead is that economic outcomes will begin to diverge between countries with differing levels of vaccine access. While this doesn’t seem to have affected attitudes towards economic optimism yet, it remains to be seen how this will play out as the year progresses. Data notes: This data is derived from Edelman’s annual Trust Barometer survey, which includes 30,000+ respondents in countries around the world. on Today’s connected cars come stocked with as many as 200 onboard sensors, tracking everything from engine temperature to seatbelt status. And all those sensors create reams of data, which will increase exponentially as the autonomous driving revolution gathers pace. With carmakers planning on uploading 50-70% of that data, this has serious implications for policymakers, manufacturers, and local network infrastructure. In this visualization from our sponsor Global X ETFs, we ask the question: will connected cars break the internet?

Data is a Plural Noun

Just how much data could it possibly be? There are lots of estimates out there, from as much as 450 TB per day for robotaxis, to as little as 0.383 TB per hour for a minimally connected car. This visualization adds up the outputs from sensors found in a typical connected car of the future, with at least some self-driving capabilities. The focus is on the kinds of sensors that an automated vehicle might use, because these are the data hogs. Sensors like the one that turns on your check-oil-light probably doesn’t produce that much data. But a 4K camera at 30 frames a second, on the other hand, produces 5.4 TB per hour. All together, you could have somewhere between 1.4 TB and 19 TB per hour. Given that U.S. drivers spend 17,600 minutes driving per year, a vehicle could produce between 380 and 5,100 TB every year. To put that upper range into perspective, the largest commercially available computer storage—the 100 TB SSD Exadrive from Nimbus—would be full in 5 hours. A standard Blu-ray disc (50 GB) would be full in under 2 seconds.

Lag is a Drag

The problem is twofold. In the first place, the internet is better at downloading than uploading. And this makes sense when you think about it. How often are you uploading a video, versus downloading or streaming one? Average global mobile download speeds were 30.78 MB/s in July 2022, against 8.55 MB/s for uploads. Fixed broadband is much higher of course, but no one is suggesting that you connect really, really long network cables to moving vehicles.

Ultimately, there isn’t enough bandwidth to go around. Consider the types of data traffic that a connected car could produce:

Vehicle-to-vehicle (V2V) Vehicle-to-grid (V2G) Vehicles-to-people (V2P) Vehicles-to-infrastructure (V2I) Vehicles-to-everything (V2E)

The network just won’t be able to handle it.

Moreover, lag needs to be relatively non-existent for roads to be safe. If a traffic camera detects that another car has run a red light and is about to t-bone you, that message needs to get to you right now, not in a few seconds.

Full to the Gunwales

The second problem is storage. Just where is all this data supposed to go? In 2021, total global data storage capacity was 8 zettabytes (ZB) and is set to double to 16 ZB by 2025.

One study predicted that connected cars could be producing up to 10 exabytes per month, a thousand-fold increase over current data volumes.

At that rate, 8 ZB will be full in 2.2 years, which seems like a long time until you consider that we still need a place to put the rest of our data too.

At the Bleeding Edge

Fortunately, not all of that data needs to be uploaded. As already noted, automakers are only interested in uploading some of that. Also, privacy legislation in some jurisdictions may not allow highly personal data, like a car’s exact location, to be shared with manufacturers.

Uploading could also move to off-peak hours to even out demand on network infrastructure. Plug in your EV at the end of the day to charge, and upload data in the evening, when network traffic is down. This would be good for maintenance logs, but less useful for the kind of real-time data discussed above.

For that, Edge Computing could hold the answer. The Automotive Edge Computing Consortium has a plan for a next generation network based on distributed computing on localized networks. Storage and computing resources stay closer to the data source—the connected car—to improve response times and reduce bandwidth loads.

Invest in the Future of Road Transport

By 2030, 95% of new vehicles sold will be connected vehicles, up from 50% today, and companies are racing to meet the challenge, creating investing opportunities.

Learn more about the Global X Autonomous & Electric Vehicles ETF (DRIV). It provides exposure to companies involved in the development of autonomous vehicles, EVs, and EV components and materials.

And be sure to read about how experiential technologies like Edge Computing are driving change in road transport in Charting Disruption. This joint report by Global X ETFs and the Wall Street Journal is also available as a downloadable PDF.